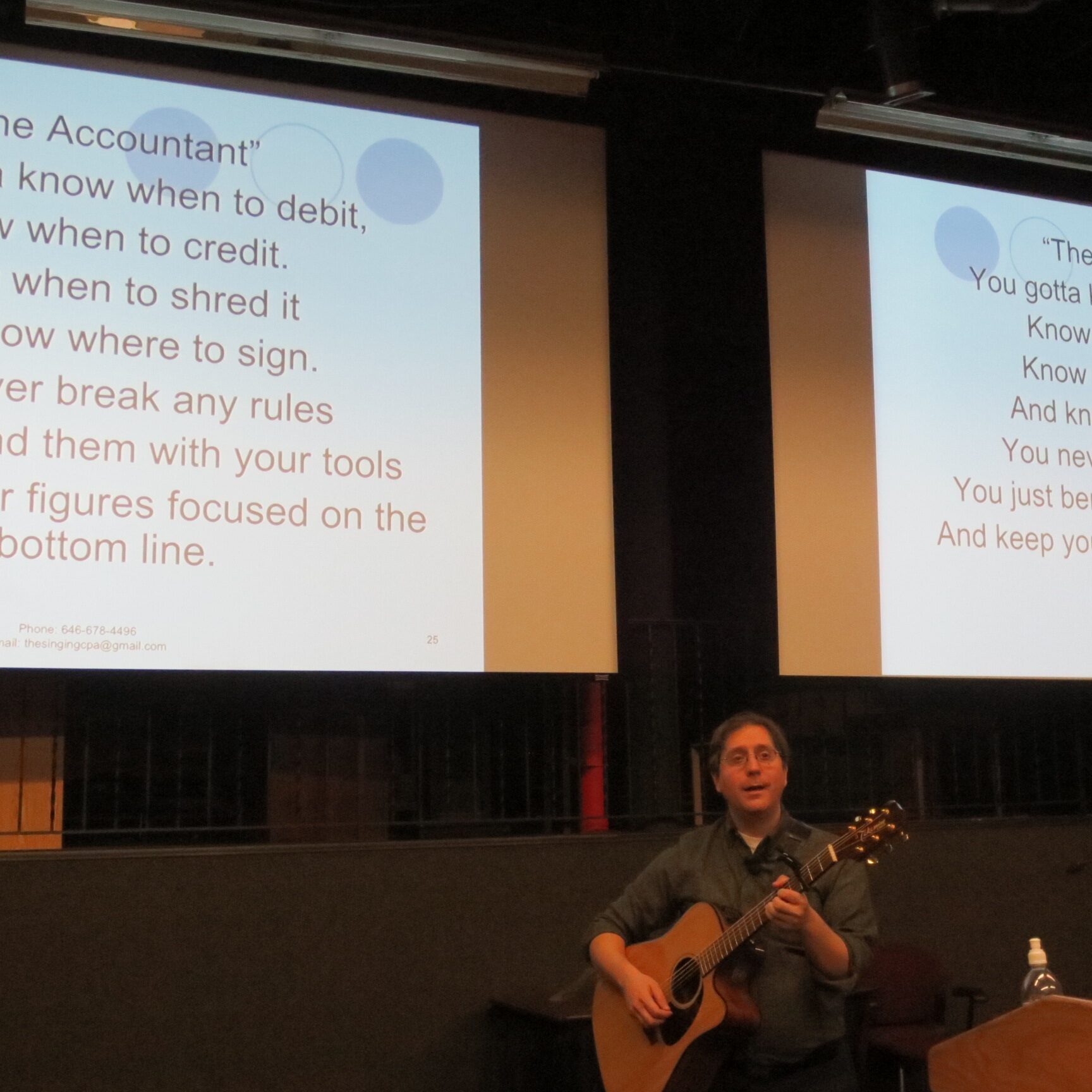

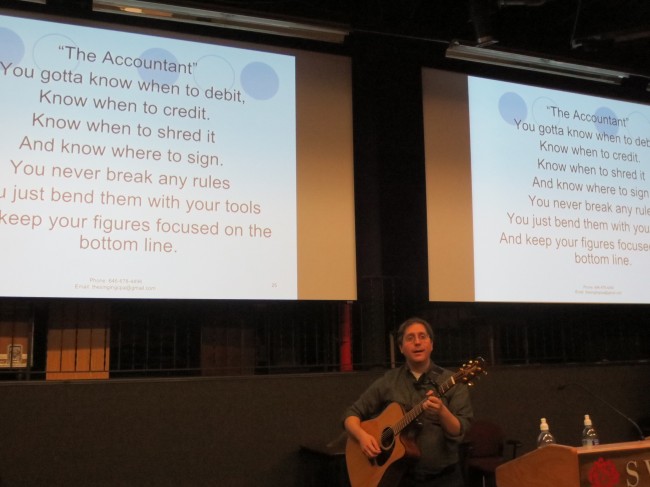

Tax season is upon us and that means a visit from The Singing CPA is in order! Once again, Steven Zelin, The Singing CPA, joined ASIFA-East for an informative discussion on taxes for freelancers and artists. The event was held on January 28th, 2014 at The School of Visual Arts. Steven’s not only an excellent accountant but he’s also a hilarious singing sensation as well! He writes and sings funny song parodies about taxes and can be found singing on the steps of the US Post Office on tax day each year. Steven’s joined us for a number of years now and his appearances are always a big hit. This year, Howard Recht (CLU, CHFC) was also on hand to answer questions about health and business insurance.

I’m reposting articles from the last few years at the bottom here for reference, and will go into detail on a few things that have changed from previous years.

Important Dates

- Filing Season Begins January 31

- 1099s should be sent by January 31

- Q4 Payroll tax returns due January 31

- NYS – notify employees of their wages every Feb 1

- 2013 Federal Tax Return is due April 15, 2014

- October 15, 2014 is the last day to efile a 2013 Income Tax Return for Tax Extension filers. Please note: This is not an extension of what you may owe.

- Other deadlines: http://taxes.about.com/od/Federal-Income-Taxes/qt/tax-deadlines.htm

Health Insurance

The Affordable Care Act is running at full speed now. If you are a self-employed freelancer – a sole proprietor, or single member LLC – and uninsured, you have until March 31st to sign up for health insurance. You can sign up via your state’s Marketplace or the government Marketplace if your state does not have one. You can also sign up for private insurance or go through a broker such as Howard Recht. If you fail to sign up health insurance by March 31st, 2014, you will be subject to a tax penalty of $95 for an individual. This penalty will increase in 2015. Here’s a handy guide I’ve written to help freelancers sign up for health insurance. Remember, health insurance premiums for the self-employed are deductible. Please consult your accountant for full details.

Home Office

For those who work from home, the home office deduction now has a new optional method of calculation, one that does not require tracking actual expenses. Instead, you deduct $5 per square foot of office space, up to a maximum of 300 square feet. At most, it’s an annual $1500 deduction per year. Since most of us live in high rent districts in New York City, it may be better to track actual expenses using the old method.

Here’s the article from last year, which discusses taxes for freelancers in more detail. As always, please consult your accountant for the most accurate and up to date information.

Internet Resources:

www.irs.gov: Excellent site with special section for the self-employed

www.dudewheresmyrefund.com: Bodacious site to check the status of your refund

For information about Steven Zelin, The Singing CPA please contact:

Steven Zelin, CPA

450 Seventh Avenue, Suite 1500 (bw 34th and 35th Street)

New York, NY 10123

877-DEAR-IRS

www.theSingingCPA.com

theSingingCPA@gmail.com

For insurance needs, please contact:

Howard Recht, CLU, CHFC

516-605-0437

800-672-6037

mailto:hrecht@msn.com