Health Insurance and The Freelance Animator: NY 2014 Edition

Getting health insurance as a working professional in the animation industry is tough, to say the least. Most of us are employed as freelancers, whether by choice or by necessity. Many of us work on productions that last anywhere from a week, to a few months, to a year. Most small businesses cannot afford to pick up health insurance for their employees, while other larger corporations are able to pick it up for the length of your contract, especially if the contract is longer than 6 months. There are times when you will have health insurance, and times when you will not.

During my career lifetime, I’ve been on more insurance plans than I can count, and have gone without at various times. Going without is no picnic in the park, but sometimes it’s all you can do. During these times, I avoid all risky sports activity like the plague. I’m even afraid to cross the street and oncoming buses or trucks make me cringe. The US health insurance system often feels like a huge gamble, one in which you are damned if you do, and damned if you don’t. Insuring yourself and your family is very expensive. We can do a lot to lead healthy lives, but there are many things that can happen in which we need health care that is not preventable. These are the things that worry us, when needing medical care can spell financial hardship and even bankruptcy.

So if one does not get health insurance from their employer or spouse/loved one, where does one obtain health insurance? Patricia Burgess and I wrote an article in 2012, listing health insurance resources for the insured or uninsured artist. Two such resources are The Freelancers Union and The Actor’s Fund.

The Freelancers Union is an organization dedicated to the needs of independent workers. They provide health insurance and retirement options, as well as education and advocacy for the independent sector. Membership to the organization itself is free. The Union has expanded substantially over the past few years. They now act as their own insurance company, and operate two medical offices, one in Brooklyn and one in Manhattan. As of press time, no information on their 2014 plans is available, which isn’t so helpful seeing as it’s January 21, 2014.

The Actors Fund is a wonderful non-profit organization that provides care and services to thousands of performing artists and entertainment professionals each year. They offer a vast array of social, financial, housing, healthcare and work services to the community. Among their healthcare services, you’ll find the Al Hirschfeld Free Health Clinic, which provides free health care to uninsured and underinsured documented entertainment industry professionals between the ages of 18 to 64. They will also provide referrals to low-cost specialists and practitioners. They offer free mammograms and free flu shots every year. The staff at the Actor’s Fund is knowledgeable and friendly.

The Actor’s Fund also operates the extremely comprehensive database of health care resources, The Artists Health Insurance Resource Center. Each state is thoroughly covered and the site contains a wealth of information regarding health insurance. If you are going to start anywhere in your search, start here by clicking on your state.

Enter on the scene the Affordable Care Act. In 2010, the US put into effect a set of health insurance reforms rolling out over the course of 6 years. These reforms range from the elimination of pre-existing conditions as a disqualifier for health insurance to providing free preventative health care. A complete list of all the reforms and their rollout timeline can be found here. For the first time, insurers cannot refuse coverage to anyone, and most everyone is mandated to purchase insurance or face a penalty. Insurance marketplaces have been set up for those without insurance and subsidies are available. A good resource on navigating healthcare for the uninsured can be found on this MB&CC article which contains helpful information on understanding your options and lowering your costs.

As a freelancer, I had many questions on how this law would affect me. In this article, I can only speak as to my experience as an individual on the NY Marketplace, NY State of Health. Not every state has their own marketplace, as there are states that are not specifically participating. New Jersey residents must sign up using the US government marketplace, while Connecticut residents can sign up at Access Health CT. Click here to find your state’s Marketplace.

You can get help signing up for insurance through Navigators and other official assistors. I sought such help through the Actor’s Fund, by attending one of their seminars on health insurance reform. These are usually held for professionals in the entertainment industry on a weekly basis and no rsvp is needed. You can check their website for specific dates. The seminar provided me with an excellent overview of the entire process of signing up for insurance on the NY Marketplace, and answered a lot of my questions.

There are four tiers of insurance plans offered on the NY Marketplace: Bronze, Silver, Gold, and Platinum. Bronze represents your most basic plan, likely with the highest deductibles, and a Platinum plan generally offers the most benefits at a much higher price. The plans and their monthly costs vary based on your county of residence. Unfortunately, the only way to see the Marketplace plans and their costs seems to be during the sign-up process.

Do you need to sign up via the official Marketplace? There are lots of insurance companies offering plans outside the marketplace, such as the Freelancer’s Union. You can sign up via their websites, but you can only qualify for a subsidy if you sign up for plans via the Marketplace.

How does one qualify for a subsidy? Subsides are available to people with income less than 400% below the Federal Poverty Level. This translates to $45,960 for single adults, and $62,040 for couples. It begs the question: How does one qualify for a subsidy as a freelancer when our income fluctuates so much? I will get into more detail in a bit, but essentially you will be asked to predict your income for that year. Your subsidy will be based on this prediction but if your income changes from your prediction, you must login to the Marketplace and update your income, so that your subsidy can be appropriately adjusted. If you fail to do so, you may be required to pay a portion of the subsidy back, or have it refunded to you depending on your circumstances.

When is the deadline to sign up for insurance on the Marketplace? Open enrollment ends March 31, 2014. In general, if you sign up by the 15th of any month, you are enrolled for the first of the following month. In NY, if you sign up by February 15th, 2014, you will be enrolled for coverage effective March 1, 2014.

What if I’m laid off – i.e. go on hiatus and lose my health insurance coverage after March 31st? That qualifies as a special circumstance, which triggers a special enrollment period. These also include losing Medicaid due to an income increase, marriage, divorce, and adoption.

What kind of information do I need to sign up for coverage via the Marketplace?

- Social Security numbers (or document numbers for legal immigrants who need health insurance)

- Birth dates

- Employer and income information for everyone in your family

- Policy numbers for any current health insurance

- Information about any job related health insurance available to your family

Where can I sign up for insurance and what are the steps involved? I will only go over the NY Marketplace as an Individual, but hopefully the process is similar on other Marketplaces. You can find your Marketplace via the AHIRC Directory. If you live in NY, visit https://nystateofhealth.ny.gov. You will be asked to register and create a NYS government ID by inputting in your name and email. You will be emailed a confirmation link to continue with the sign-up process. You will then have to answer 3 security questions and create a password. After some identifying questions specifying your gender, date of birth, social security number, address, and phone number, you will be asked to detail your household info, i.e. whether or not you are married and if you have dependents.

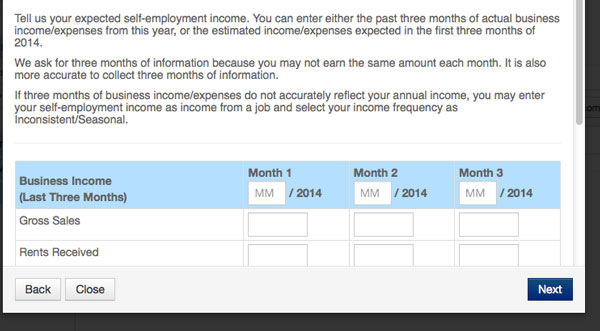

Now comes the fun part. You will be asked for your income information. Any W-2 jobs you’ve had in the last year will be listed here. If you’ve finished the contract on that job – and most likely as a freelancer you have – then you have to indicate that you are no longer working at that job. You are asked if you expect your income to be the same as the previous year. As a freelancer, i.e. – if your income is not solely based on a W-2 and fluctuates from month to month – you will most likely have to project your income. In NY, they have asked that you project your income for the next 3 months:

Any source of additional income such as unemployment insurance, social security benefits can be listed after this step. You will also be asked to input any deductions you normally take throughout the year, and to detail any other health insurance coverage you have. If there’s a huge difference in income from the previous year to this year, you will be asked to explain it. Loss of job is one such explanation. All of this information is used to calculate your eligibility for a federal subsidy to help you pay for insurance.

All of this took me about 3-4 hours. Some of that time is spent digging through old tax returns to calculate all this information. Again, if your income changes from what you’ve inputted, you must login and have your subsidy recalculated. It’s a very long process for the self-employed especially. After you input your income, plan on another 3-4 hours to choose a plan that works for you. Luckily, you can stop the process and come back to it anytime, so long as you remember your username and password. Write it down.

Choosing a plan is tricky. I can’t list them all here because everything offered is based on your county of residence and cost depends on your income. You will need to take into consideration the premium, the deductible, and the out of pocket maximum which all vary per plan. Check out the copays for PCPs, Specialists, and Hospitalization. Most importantly, take a look at their network and see if your doctors and preferred hospitals are covered. All the plans on the Marketplace are HMO’s, which means you must choose a network provider to fully utilize the plan’s benefits. I was happy to note that the plan I chose did not need a referral to see a Specialist. Don’t forget to pay attention to the prescription drug benefits as well. The Marketplace will list all the plans and there’s a pretty good filtering system, where you can choose to see plans such as by tier and by doctor preference. This was helpful in making sure that my doctors were covered by the plan I chose. Even so, I had to change a doctor because not all of them are accepting all the plans on the Marketplace. Hopefully, networks will expand with time because changing doctors is not ideal. One tip, try writing down or taking screen shots of the plan details. You will be unable to see those details again once you finish the process. The carrier will send you a notice with this information but it takes a long time to arrive in the mail.

You will have to check the NY Marketplace for accuracy, but I was able to find a list of insurance companies participating in the NY Marketplace here. Of special note for freelancers is the Freelancers COOP or Health Republic of New York. COOPs are consumer-run health insurance cooperatives, funded via government loans to encourage competition and lower prices. Nationwide, there are 23 such COOPs. Health Republic is affiliated with the Freelancers Union, but is run entirely separate from the Union. You can buy a plan directly from their site, but if you buy it through the Marketplace, you may qualify for a subsidy.

After you are done signing up for insurance, the standard advice is to call your insurance company to confirm that they have received your name. Your first payment is due on the first of the month. You will likely not receive your first bill in time, but do not wait for it. Call your carrier and ask them how to make the first payment ahead of time. About 3-4 weeks later you will receive your insurance card and a welcome packet detailing the plan.

NPR has prepared a comprehensive list of questions and answers about the Affordable Care Act. I found the list very helpful. You may also qualify for certain cost-sharing reductions based on your income. These savings are for the Silver Plan, but in effect are more beneficial than higher tier plans. There are 3 ways to take your subsidy: take it month to month to lower your monthly premium, pay the full premium now and get a refund at tax time, or take some now and some of it later – you fill in the amounts. Also important to note is that you can cancel your insurance at any time, if you end up getting a job that offers it to you. If it’s contract based, you can go back on the Marketplace and sign up for coverage, when your employer-based coverage has ended.

Please note that any of the advice and information offered here may not be fully accurate and could change. Even the law itself continues to undergo change. Everyone has his or her own special set of circumstances and you’ll need to check with your Marketplace to get the most up-to-date accurate information. Good luck navigating it all and here’s to a healthy 2014!

Update: 3/11/14: The Freelancer’s Union has posted their 2014 plans on their website. Rates in various counties differ but the general range for an individual plan is $471 for the bare bones bronze plan, $548.19 Silver, $688.22 Gold, and $799 Platinum. The insurance is not a part of the NY Marketplace and does not qualify for subsidies. Health Republic offers insurance both privately and through the NY Marketplace. At $365 for a Silver individual plan, it would seem the better bargain. Still, I would take time to compare full details of plans both on and off the Marketplace and who takes your doctors before committing.